Jun 11, 2025

6 Reasons Why Congress Should Keep Solar Tax Credits

“The House just passed a bill that risks widespread blackouts in the US,” warns a short video from the Solar Energy Industries Association. “The GOP-backed Big, Beautiful Bill will cut clean energy credits, lead to job cuts, and raise our energy prices.”

The bill is now in review in the Senate and it’s not too late to revise it, as leaders in tech and other industries are urging, or even to entirely KILL the BILL, in the words of Elon Musk, who hates the bill so much that he broke with President Trump over it.

What’s at stake?

With the growth of electric vehicles and AI, America will need much more electric power in the future to avoid price spikes and possibly even blackouts. And practically speaking, most of the nation’s new power must come from solar, the source that’s the quickest to deploy — and the cheapest.

Below, we’ve collected the best graphics we’ve seen recently to quickly illustrate why federal support for solar is crucial not only to our industry but to the whole economy.

1. America Needs Much More Electric Power

Key parts of our economy including transportation are switching to electricity while new uses for power like AI data centers are growing fast. Experts disagree on just how much power we will need. But they all agree that the coming decades will see an explosion in demand for electricity.

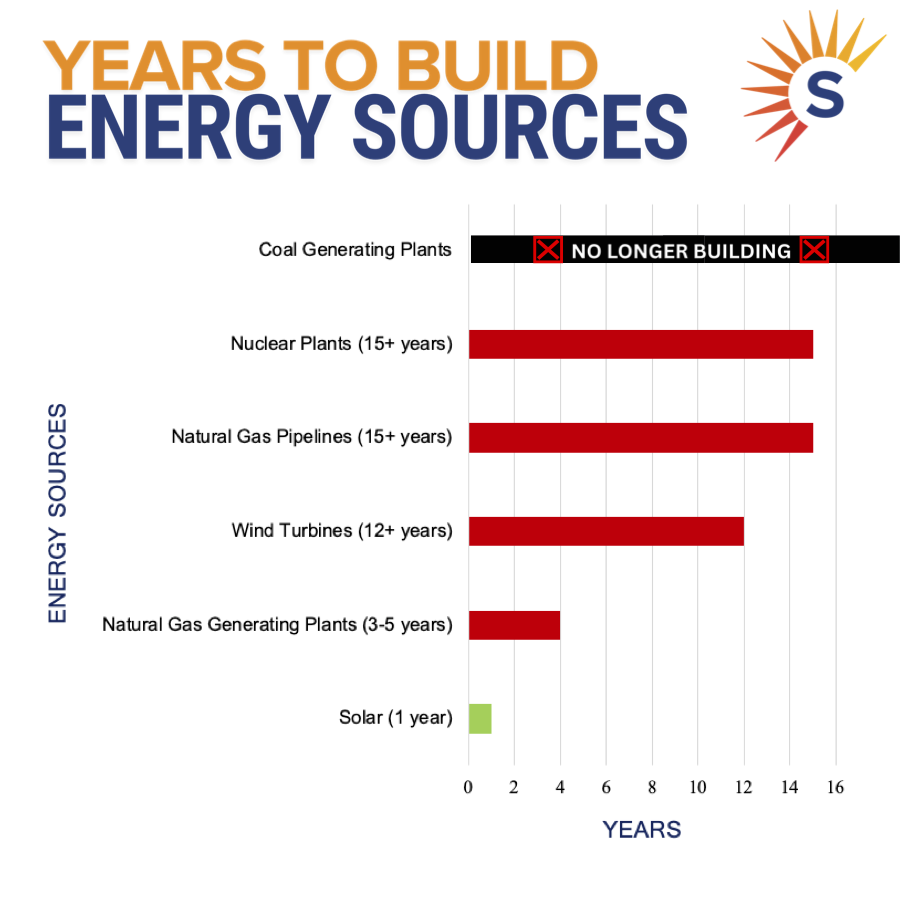

2. Solar is the Fastest to Build

Higher demand from electric cars, buses, and trucks along with proliferating data centers (including hyperscalers that draw as much power as a city) is already pushing the electrical grid to the limit. Today, states with high energy usage, like Virginia, the world capital of data centers, have to import increasing amounts of power from out of state, which has gotten more and more expensive as demand for power has outpaced supply. Only solar can be installed quickly enough to keep up with such fast-growing demand. All other major energy sources are too slow.

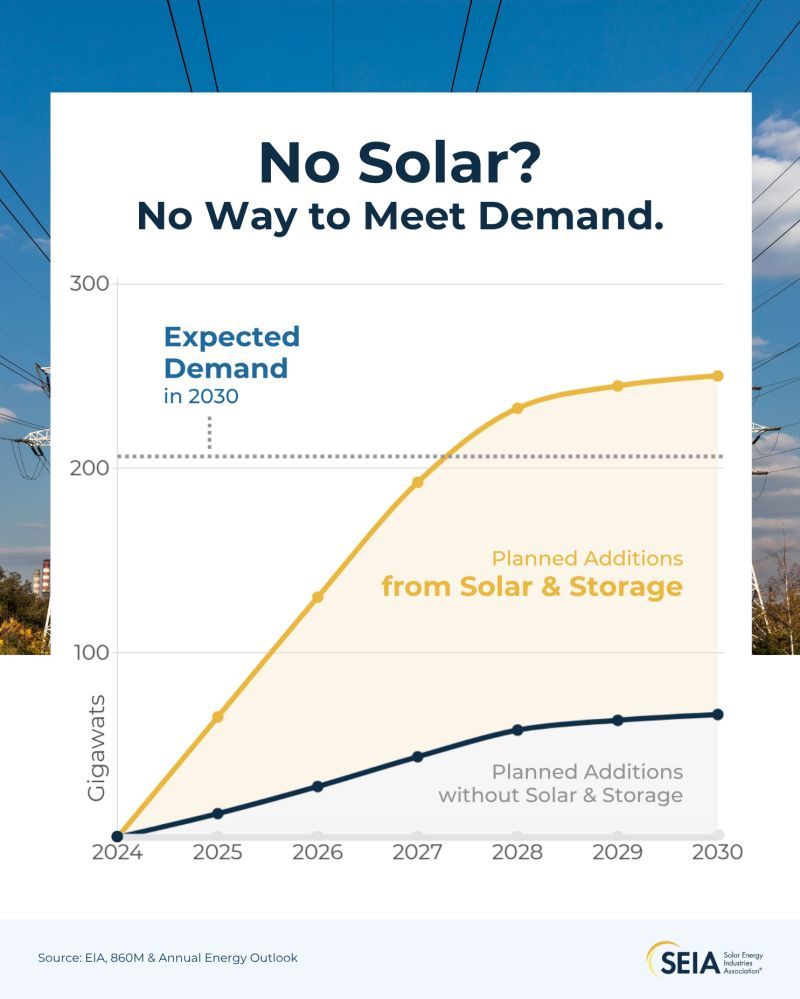

3. Most New Power Must Come from Solar

Because solar is the fastest and cheapest to deploy, 75% of new power generating capacity in the next few years is projected to come from solar coupled with battery storage to tap into solar power at night. Demand for power will begin to outstrip supply unless enough solar is installed quickly enough to keep up.

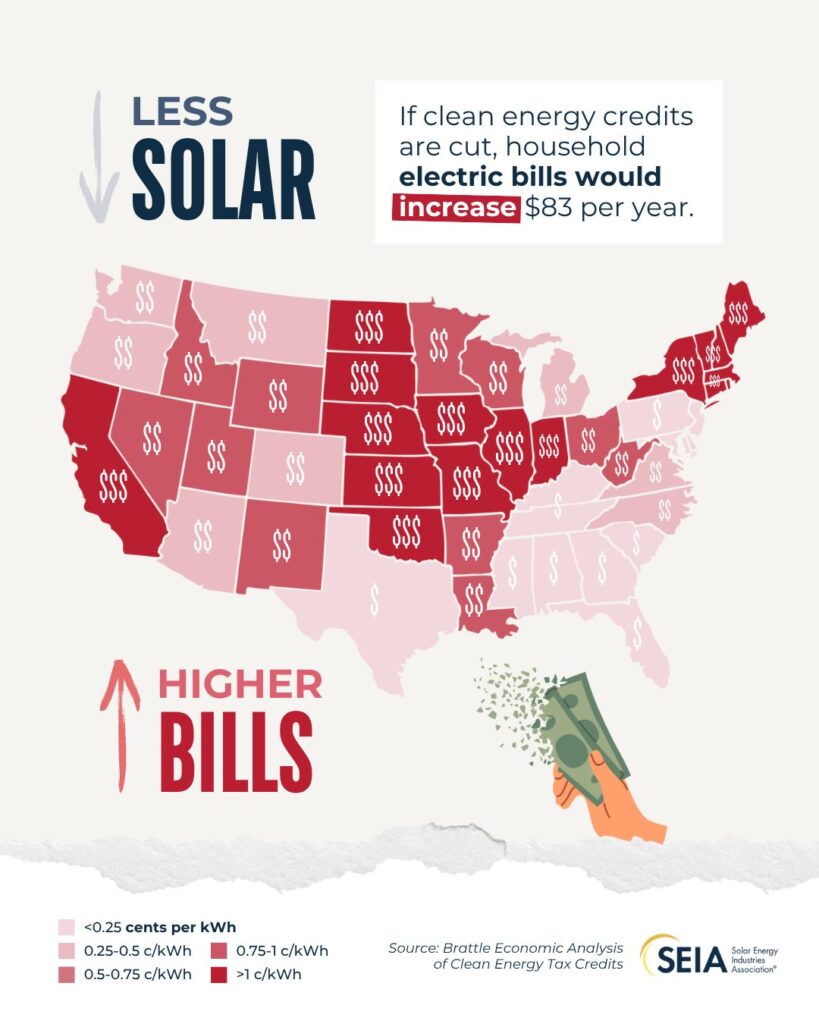

4. If We Don’t Get Enough Solar, We’ll Face Price Spikes

The graphic shows how power costs will rise for homeowners, but experts also say that electric bills will increase for schools, hospitals, churches, and businesses.

5. Repealing Energy Credits Will Add Less Power to the Grid

If the Senate agrees to all the cuts in incentives for solar and other forms of energy in the budget bill passed by the House, it will cut investment in electric power and clean fuels production by $1 trillion over the next ten years and threaten $522 billion of investments that have been announced in supply and manufacturing of clean energy. This drop in investment will “substantially slow electricity capacity additions,” according to the REPEAT Project.

6. Solar Isn’t Asking for Special Treatment — All U.S. Energy Sources Get Federal Incentives

Over the last couple decades, tax incentives have helped bring down the cost of solar while enabling it to spread widely. Continued public support for solar will help it get even cheaper and spread even further. But is it fair for taxpayers to help solar? The U.S. subsidizes all major forms of energy, because affordable and plentiful energy is crucial to the economy. And over time, federal support to help grow solar has been only a fraction of subsidies given to traditional energy including oil and gas as well as nuclear — subsidies which continue today, despite the maturity of traditional energy sources.

Defend American Energy

A time of rapidly rising demand like today is not the time for politicians to play partisan politics with America’s energy supply — it’s the time to install all the energy we can as quickly as possible.

And the solar industry is ready to provide that energy at every scale.

- Utility-scale solar developers will build large solar projects well suited to supply the electrical grid and big power users like data centers alike.

- Rooftop solar developers like Secure Solar Futures will add resilience to America’s energy system by putting solar on schools, hospitals, and businesses that are leaders in their communities.

- And if tax incentives for residential solar survive, then thousands of small businesses in every state will continue to install solar panels on the roofs of homes and building shared solar projects so that more families can protect themselves from future increases in power costs.

Yes, solar has all sorts of advantages over traditional energy: it’s clean, it’s domestic, and it creates jobs and opportunities to open new businesses. But facing an impending energy shortage, the most important reason to support solar — and not try to squash solar — is that no power source is quicker to add to the grid. And with no fuel cost, solar is also the most affordable way to generate electricity.

Want to know more or get involved in the campaign to save federal incentives for solar?

The Solar Energy Industries Association has put up a website showing how Solar Powers America with helpful data and stories of how solar has helped families and businesses, along with a way to easily contact legislators online.