Jun 26, 2017

How Colleges Can Aquire No-Cost Solar

Increasingly, higher education institutions are scrambling to meet the demands from students and faculty to go green with clean energy. More colleges are also committing themselves to campus carbon reduction targets with no clear plan on how to achieve them. And for many schools, simply signing up for some “green power” plan from their utility company often comes at a premium cost. Meanwhile, students and faculty are insisting that solar panels be located right on campus — where everybody can see them and where the college will get the most recognition for using clean energy.

Yet college administrators find the costs of owning and installing solar prohibitive, and thus find themselves on the horns of a dilemma. The innovative solution to this dilemma through no-cost solar Power Purchase Agreements (PPAs) has emerged for all to see, yet few seem aware of it.

With tight capital budgets and constrained borrowing ability, university and college officers find it challenging to balance these demands for innovation, while keeping their institution operating within budget.

Today, the call for solar panels on campus at colleges and universities comes from every side:

- Facilities and sustainability directors often ask how the institution could possibly pay for going solar

- Students on admissions tours ask what initiatives the college is taking to combat climate change

- Faculty want solar as a hands-on research tool for their students to study new energy technology

With all these compelling reasons for colleges to go solar, administrators are scrambling to find the money to buy solar panels. Traditional approaches to financing capital improvements yield no results for this challenge. It requires a paradigm shift in how colleges finance solar, a possibility that became possible thorough a change in legislation in Virginia in 2013.

In 2013 Secure Futures sponsored new legislation with Senator Edwards, and negotiated its approval with Dominion Power, the “Solar Power Purchase Agreement (PPA) Pilot Program”, that enables solar PPAs in Dominion territory. This approach took other states by storm 10 years earlier when the first solar PPA was introduced by SunEdison and Wells Fargo Bank in California.

Constrained by limited cash flow and borrowing ability, an administrator might say “solar would be nice, but we really cannot afford to buy it with our limited capital budget. Maybe next year…” When these same college administrators learn about an alternative approach for financing solar without capital or operating expense, and at no risk, they often ask “why aren’t more people doing this?” The answer remains simple: it represents a new paradigm for no-cost (i.e. no capital or maintenance cost) solar, only made possible in Virginia since 2013.

To compound their dilemma, administrators face a chorus of environmental groups asking why the institution has not gone solar yet. Many of these administrators remain unaware of the no cost solar PPA option.

Why Buying Solar Doesn’t Pay for Colleges

Most college procurement goes like this: identify the problem, committee(s) searches for a solution, CFO weighs it against other priorities, administration budgets for it, facilities director finds a vendor, vendor installs it and submits a bill, College pays for it, tuition goes up. The traditional way for colleges to go solar poses obvious problems:

- Big Capital Expense: Buying solar panels means spending lots of money up front to pay for equipment and installation, with more than a 12 year payback. Getting a loan might reduce the initial cost, but interest payments can eat into any money savings that the solar panels were supposed to provide.

- Leases create a debt burden for the customer: While a lease would seem to work, it creates a debt liability for the institution, whereas a solar service agreement does not, as it is performance based. In addition, a third party owner cannot apply the 30% federal tax credit in a lease to a tax-exempt entity, thereby reducing potential savings to the customer.

- No Tax Benefits: As non-profit organizations, colleges do not pay any federal taxes, and cannot benefit from the 30% federal tax credit and accelerated depreciation. As a result, any non-profit would effectively pay 50% more to buy solar panels than a homeowner or a commercial business.

- Performance Risk: A college that decides to buy its own solar panels has to find a trustworthy solar installer and then hope that the installer does everything correctly, from engineering, procurement, contracting, to energy monitoring and more.

Solar PPAs on Campus

So if buying solar panels is too expensive and risky, then how are so many colleges and universities in Virginia these days, like Eastern Mennonite but also Washington and Lee and the University of Richmond, managing to go solar?

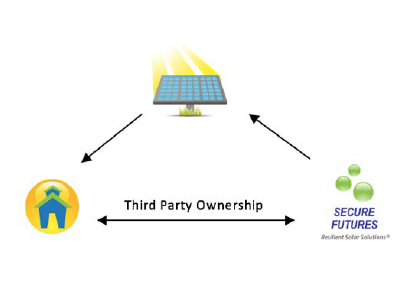

These colleges are using a modern financing system known as a solar Power Purchase Agreement (PPA) involving third-party ownership. Under a PPA the panels are financed, built, owned, operated and maintained by the solar company. Unlike a lease, the solar service agreement does not show up as a debt liability on the college’s balance sheet. As a performance-based service agreement, a PPA developer assumes all risk as they only get paid from the sale of electricity generated by the solar array. And unlike power from your local utility company, power from solar panels on campus is both local and clean.

The video below explains how a PPA can help a college or other public purpose organization get solar through a monthly payment lower than your current electric bill.

How a Solar PPA Works

A PPA provides customers with solar power for a fixed period of time (usually 20 years). Simply put, the customer purchases the electricity that the solar PV system generates.

In addition to the educational, environmental and public relations benefits solar energy provides, PPAs and Solar SGAs supply clean, renewable energy to the host customer with:

In addition to the educational, environmental and public relations benefits solar energy provides, PPAs and Solar SGAs supply clean, renewable energy to the host customer with:

- No capital costs

- No maintenance costs

- No performance risk

- Predictable service fee payments for the life of the agreement at less than the avoided utility cost of energy

- A path to ownership (most PPAs offer the option for the customer to purchase the solar panels after the five year tax benefits are used up, at a considerable discount, which can produce additional money savings)

An additional financial benefit of PPAs to go solar is in their long-term price stability, which provides substantial reduction in electricity, fuel and demand charges to the host customer. While fossil fuels continue to experience price volatility, solar PPAs and Solar SGAs hedge against this risk by supplying reliable power at or below what the customer currently pays for its electricity for the 20 year contract.

Virginia Colleges and Universities that Have Gone Solar with Secure Futures

We’ve helped all of these schools get solar on campus without the expense or hassle of having to buy and maintain their own solar panels:

- Eastern Mennonite University, Harrisonburg

- Washington and Lee University, Lexington

- University of Richmond

If you’d like to know whether your college or university might quality for solar at no money down under a PPA, then contact us for a free solar evaluation.